Our niche is, we call it, six-figure cannabis jobs. So roles of strategic importance to plant-touching companies in the cannabis industry. A third of our roles are C-level hires and the rest of those roles are mid-management and senior salary professionals down to the store manager, the cultivation manager, accountant level.

Our mission is to build a conscious-cannabis community one hire at a time. And obviously, this industry needs people in it that believe in its potential to help mankind, and help social problems, and create jobs. So our goal is to get the right people into the industry so the industry can be successful. We work with everything from marquee brands on the West Coast, to multi-state operators and single state operators outside of California.

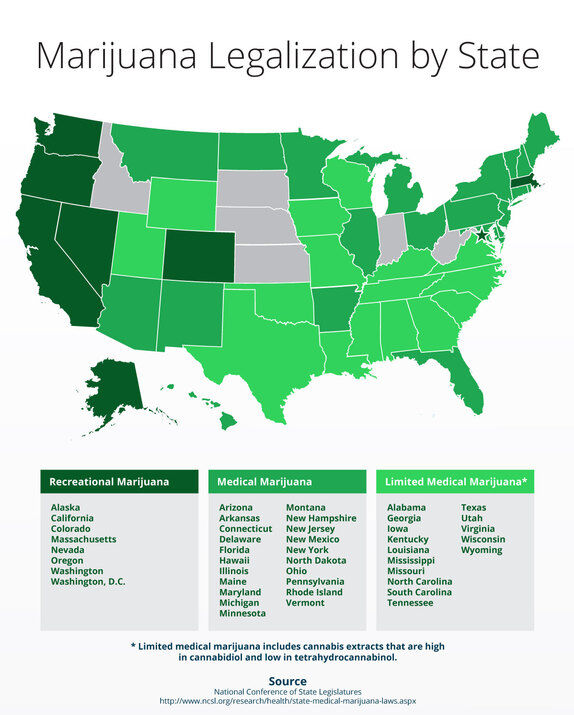

In the last 12 months, we’ve done two thirds of our business outside of California, as an example. So there’s basically, I’ll call them six different areas that we’re seeing a lot of traction right now, geographically around the country. Those are Northern and Southern California, which are two different regions. Northern New Jersey and Pennsylvania, which I’ll call its own region. Massachusetts, Michigan, and the Northern half of Illinois.

So that’s really our focus, and we’ve placed hundreds of folks in roles of strategic importance in this industry in the past three years, and including dozens of C-level positions.

For states that have had a huge illicit market, the challenges of building an industry that is designed for patient safety and tax revenue often crowds out legacy operators that have been in a state, whether it’s black market or a medical gray market. Just based on the costs of actually being able to operate in a legal market.

So I think for this industry to succeed, the companies that are succeeding are a mixture of your people that have been living the lifestyle of cannabis from a business standpoint for a long time. They understand how to grow the plant, how to make products from the plant, and then marrying those people with people from the outside that know how to run a profitable business, and do forecasting and build some type of systems and structure within a company. So the organizations, in my opinion, that are a combination of both of those people, are doing better than others right now.

Well, I think for every multi-state operator, that at this point, is not in financial duress, like your TerrAscends of the world, and your Curaleafs of the world, or your Ascend Wellnesses of the world; companies like that have that (mentality) of, “We’re here to not just get rich quick. We’re here to build a company that stands up to the test of time over the next 20, 30 years.” And because of that, they have financial minds, and supply-chain forecasting minds, as well as lots of people internally, whose main focus is to take care of those plants, and make them healthy, and make them harvest, and get them to stores. Then people that know how to turn those plants into live resin and things like that.

So I’ve seen some of the bigger companies really, not only put a value on having those people included within the culture, but also how important they are for their ultimate success. So that would be an example.

You look at cannabis over the past 18 months, and, I’ll call it, cannabis was in a recession.

It was all the companies that went public on first-mover valuations when investors started asking, “How are you going to be profitable at a tough time defending those valuations?” And that’s the same thing for the private sector companies in cannabis, too.

On the West Coast, you saw a lot of private companies raising tens, if not a hundred-plus million dollars of total capital from outsiders in 2018 and the first part of 2019. And all of a sudden, it’s really tough to defend that valuation. And so what that forced in response to that, “how are we going to be profitable?” It forced companies to really understand what they were good at, and how they could make money.

And being profitable with cannabis is really hard. There’s a lot of reasons why. 280-E is a big one. The price of flower being so high is a big one, if you’re not a cultivator.

So the companies that were able to figure out what they were good at focused on how they’re going to make money and be profitable, got a boost from the essential services designation because they were operational. There’s more customers in many places; and sales were on the increase. And so they’re doing better than ever as a result of COVID. If they’re able to figure out how to be profitable before COVID, and they dealt with that internal restructuring, then COVID was a boost.

However, if they were going into COVID, and they still hadn’t really figured that out — and they needed to raise money in order to keep going — COVID basically almost accelerated the demise, if you will, of having to… You can’t really declare bankruptcy, but having to basically recapitalize your entire company, and give control to somebody else.

What’s going on right now is that there’s new facilities opening up. Whether it’s in California, where there’s been cannabis deserts, where it’s only like 35% of the state has licensed cannabis activity still. All of a sudden, they’re like, “Wow! We’ve got to get other states that don’t have it…and cities that don’t have it.” Or like, “We got to open this up. We need tax revenue.”

But in states like Massachusetts and Michigan, they’re newer rec markets. The cat’s out of the bag. These licenses have been won. The construction’s been done. There’s new facilities opening up. Even in Pennsylvania, the medical market has really taken off.

I think Jersey, it will and it is. It’s just still so small. But I think, before COVID, there was construction happening. There’s new territory’s opening, but with essential services designation, and being able to stay operational, those projects still got done with built in demand.

And because of that, the industry is creating jobs — because you’re opening a store, it takes 50 people to work there. If you open a cultivation, it takes 50 people to work there. And so, I think that, in general, the job market for cannabis is stronger than it’s ever been right now. We’re busier than we’ve ever been as a business. I feel very fortunate to say that, because I know it’s crazy out there.

I think that there’s a lot of anticipation that New Jersey will go first. Meaning, it has the chance to go first, later this year. It’ll be the first rec state out of the tri-state area.

Obviously, you have other things you’re dealing with. Pennsylvania is definitely embracing the medical side. So they’re maybe not too far along, but there’s a lot of thoughts that the entire tri-state will go and New Jersey will be the front runner. And I think that for New Jersey specifically, they’ve been friendlier from a taxation standpoint than other states, in terms of the support, getting the industry off the ground. At least so far. I know there’s been a ton of interest.

If you look at the original license holders for medical in New Jersey, there’s been a ton of interest in trying to get “plants in the ground,” “boots on the ground,” access to New Jersey based on the future growth.

You’ve seen companies like Ascend Wellness (which has a pending acquisition of Greenleaf subject to DOH approval) come in and buy licenses. You’ve seen your multi-state operators like TerrAscend come in and buy licenses. I know Acreage is there. I know Curaleaf is there. Columbia Care is there. Some of the bigger shops, bigger MSOs have come in and try to get their hand in the Jersey medical market in anticipation of it being rec. And I know that Jersey, and rightfully so, a lot of the citizens were like, “Well, we need more operators from Jersey running Jersey cannabis companies. Whether it’s for social justice, which is huge, or whether it’s just, we don’t want corporate cannabis coming in here. We want this to be a net boost for us in the state.”

And I know that there were a bunch of applications that went out, and maybe there was a flaw in the process. And that basically all seemed to be stopped because of that.

And because of COVID happening, in terms of figuring out those additional licenses that were going to be issued. And maybe put on hold to see if rec actually passes later this year. But generally speaking, there’s a lot of interest in New Jersey cannabis. It’s top of mind for not only being the domino that falls to get the entire Tri-state area adult use, but also just the appreciation of that market has a ton of potential, even in New Jersey, even with New Jersey citizens when it’s adult use.

Absolutely. Every state has challenges and obstacles, but generally, it’s not slowing down this push to open access to this plan. Whether it’s for taxation, job creation, decriminalization; whatever the purpose is. So there’s a lot of enthusiasm around Jersey, specifically. A lot of people outside of Jersey think Jersey is going to do it. Who knows how that really plays out. It’s incredibly complicated and Jersey is an incredibly complicated political state. But I’d say, people are more excited about New Jersey than they are New York, right now, in terms of it actually getting movement and that’s huge.