The “Free State” is sort of a conundrum. With adult-use imminent, it should be able to feast upon masses of the unserved* from surrounding states: Pennsylvania, West Virginia, Delaware, and Virginia.

Salutations and hello to all you folks in Baltimore, Rockville, Frederick, College Park, Annapolis, and, of course, Capitol Heights. Over here, we heard a birthday is slated for July 1st. Maryland is the latest and greatest adult-use marketplace for us to call home, and we’re excited. A little apprehensive at first blush, but like brides, all markets are ultimately beautiful, or at a minimum, respected.

The “Free State” is sort of a conundrum. With adult-use imminent, it should be able to feast upon masses of the unserved* from surrounding states: Pennsylvania, West Virginia, Delaware, and Virginia. I won’t speak in length about why or what makes these surrounding medical markets massive contributing factors to the growth and trajectory of the adult-use Maryland market, but to put it and show it simply: Maryland gets to play host in a place and time to people outside the state that wish to be guests—paying guests to boot. That being said, there are some serious quirks in this market that may deter that “up and to the right” trajectory.

PROPOSED BILL AND ITS IMPACT

The Maryland Medical Cannabis Commission, soon to be renamed the much easier-to-remember Maryland Alcohol, Tobacco, and Cannabis Commission, was enacted by the Maryland General Assembly ten years ago in 2013 to implement cannabis medical programming. Several years later, in 2017, the first medical cannabis businesses were licensed in Maryland, with doors opening at the tail end of 2017. What’s interesting, and perhaps telling, is the time in which political and regulatory acceptance was achieved and when businesses actually opened. Similar to other cannabis coastal enclaves, there’s a fair amount of political maneuvering to be had if you want something, anything really, to be done. So keep that in mind as we go on here; timetables may be subject to change, but it’s certain that constituencies want their fair shake.

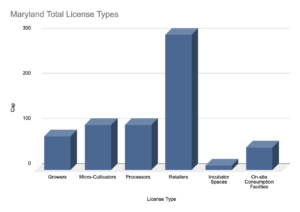

On March 10th, the state’s house of delegates passed the bill to create the formal framework for adult-use marijuana commerce, following November’s election approval. As it stands, on July 1st, doors open and hearts and minds go shopping. That’s neat. The bill proposed a cap on the total number of license types: 75 for growers, 100 for micro-cultivators, 100 processors, 300 retailers, 10 incubator spaces, and 50 on-site consumption facilities. That’s not so neat.

With 300 retailers servicing the entirety of the state and a population that boasts about 6 million people, that works out to about 5 stores per 100,000 people. As we’ve stated previously and as has been demonstrated by current market dynamics, that simply isn’t enough. “Not enough” leads to gaps in service and provision, and service not being met by one format of cannabis will be met by another: the gray or illicit.

Thankfully, the taxation scenario put forward so far is rather amenable! Taxes are slated at six percent for the first fiscal year starting in July, with a tepid increase of one percent each following year until 2028, with the endpoint being 10 percent. The really intriguing parts are that localities cannot impose additional taxes, prohibit establishing zoning and other requirements that burden licensees, or stop the transportation of deliveries within or from outside that local jurisdiction. In essence, cannabis companies in Maryland get something of a reprieve from NIMBY laws (Not In My Back Yard….so far).

IMPLICATIONS FOR EXISTING CANNABIS OPERATORS

That’s great for many involved, but the quirk in the cosmos is the manner in which existing medical operators convert for adult use. Now, this is as it stands currently, but if you’re in good standing with the state of Maryland and have been a licensee operational before October of 2022, you have to pay a one-time fee anywhere from $100,000 to $2,500,000 based on the licensee’s 2022 gross revenue. So, if you’re a grower or processor, the minimum fee is $100,000 if your gross revenue for 2022 was less than $1,000,000, or 10%, and up to a maximum fee of $2,500,000 if your gross revenue was more than $20,000,000. For dispensaries, it’s the same except the maximum conversion fee is $2,000,000 if gross revenue was more than $20,000,000.

Hence the conundrum: It’s great that you want local and support local, but this seems awfully like a penalty: a penalty that several businesses can’t absorb, which might compel small business owners to do literally whatever they can, including giving up a chunk of ownership, or get mired in debt, to satisfy the fee. Or they can take the risk of striking out by converting. Given the big picture and the way cannabis funding is right now, this writer thinks that this will force local homegrown heroes to agree to terms that they can’t and shouldn’t live with from groups or interests that are potentially not even local. As odd as this reads, it’s almost like self-inflicted gamesmanship, or at least an invitation for some kind of abuse. The state can do better and should.

Ultimately, folks, it’s yet another market slated to eclipse the three-comma club within 18 months. However, with pending legislation in surrounding markets imminent and a serious quake felt in the general economy, the state, not the operators, needs to step up to the plate, and soon. I think this market is going to live up to its Italian (curveball) state motto: Fatti Maschii Parole Femine: Strong Deeds, Gentle Words… just not out of the gate.

Curious to learn more? Email me at Mike@flowerhire.com; all are welcome, unless you want to debate. For that, just call me directly.

Mike Siebold is a strategic advisor and investor to several cannabis teams domestically. His exposure to the hiring demand and movement of people within the cannabis industry gives him a unique perspective on the prospects and viability of players across the entire ecosystem.