By Anne Pennington & Mark Gannott. December 11, 2020

…The best-case scenario from a business perspective is to hire as many permanent workers as possible with the understanding that profitability should increase correspondingly with the cannabis market.

Overview of the Current Job Climate

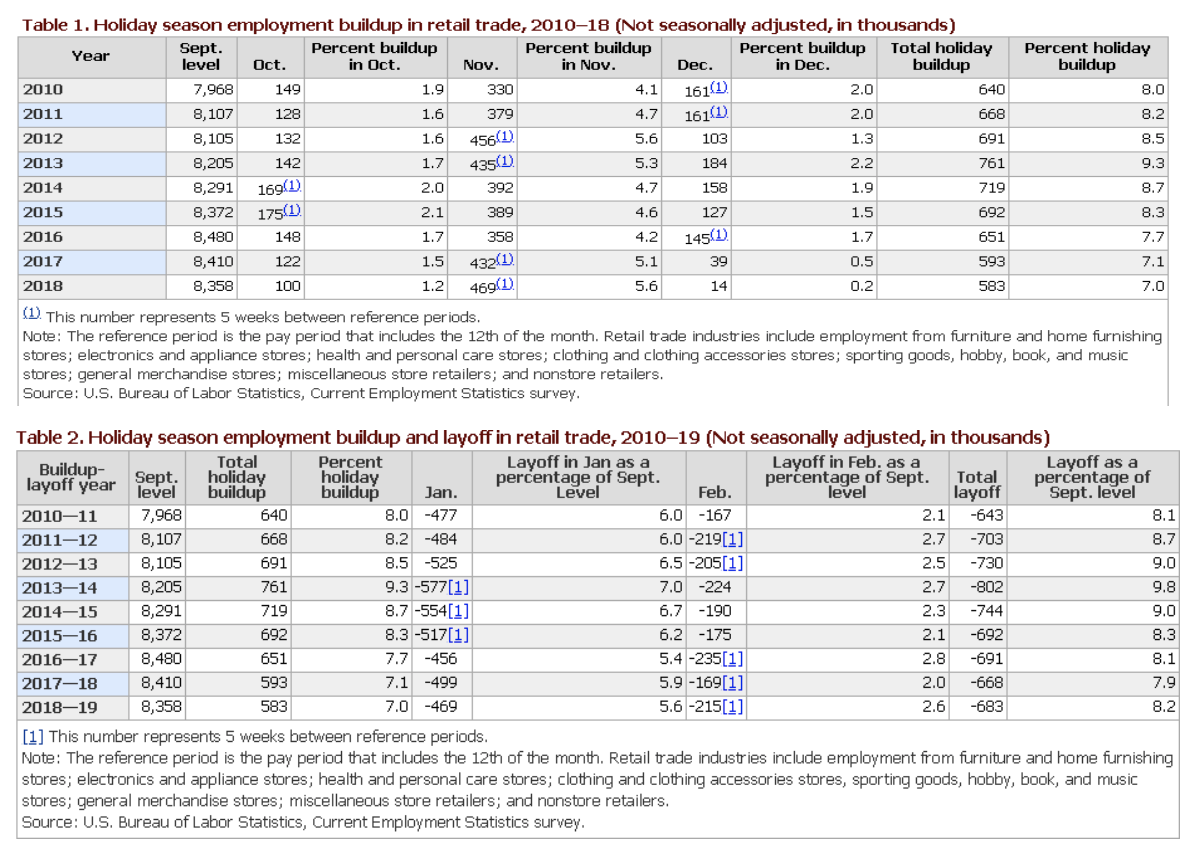

Prior to the pandemic, the unemployment rate had fallen to 3.5%, the lowest level since 1969. (Bureau of Labor Statistics, “BLS”) That said, the seasonal build up and fall off, as shown in Figure One, was still rather dramatic: in 2019, retail trade laid off 683,000 seasonal workers, or 8.3% of the base employment. This ebb and flow has traditionally been viewed as the most sustainable model. After all, labor costs are often among a firm’s highest, and frequently full-time workers are more costly than part-time, at least on paper.

However, this line of thinking often myopically neglects less visible pecuniary benefits to maintaining human capital, like reductions in costs for sourcing good workers and efficiency benefits workers experience with greater time on the job. Revealed preferences reflect these advantages (and the increase in just in time delivery via e-commerce) the percentage of seasonal workers had been declining steadily, as indicated in the BLS’s tables below.

Everything changed when COVID attacked. The unemployment rate skyrocketed to 14.7% in April, before gradually coming back down to 6.7% in November (BLS). This is still a staggering 91% higher than last year’s. Moreover, it does not begin to encompass the extent of devastation lain waste by COVID. Economists will spend decades detangling the deleterious effects of diminished dollar multiplier effects, the eradication of savings, and the downstream impacts of gutted tax revenues in areas as various as education, healthcare, and the social safety nets that multitudes found themselves reliant upon—many for the first time—in the wake of the worst fiscal climate of the last century. (All this to say nothing of the plethora of negative externalities the scores of deaths inflict upon society in areas far beyond pure economics.)

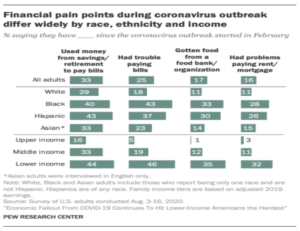

Yet, this financial hoarfrost did not impact all populations and industries equally. As shown in Pew Research’s table below, the virus adversely affected lower income professions and people of color most. In terms of jobs, generally, unskilled labor is also the lowest paid and there are far fewer opportunities for remote (and thus pandemic resistant) work.

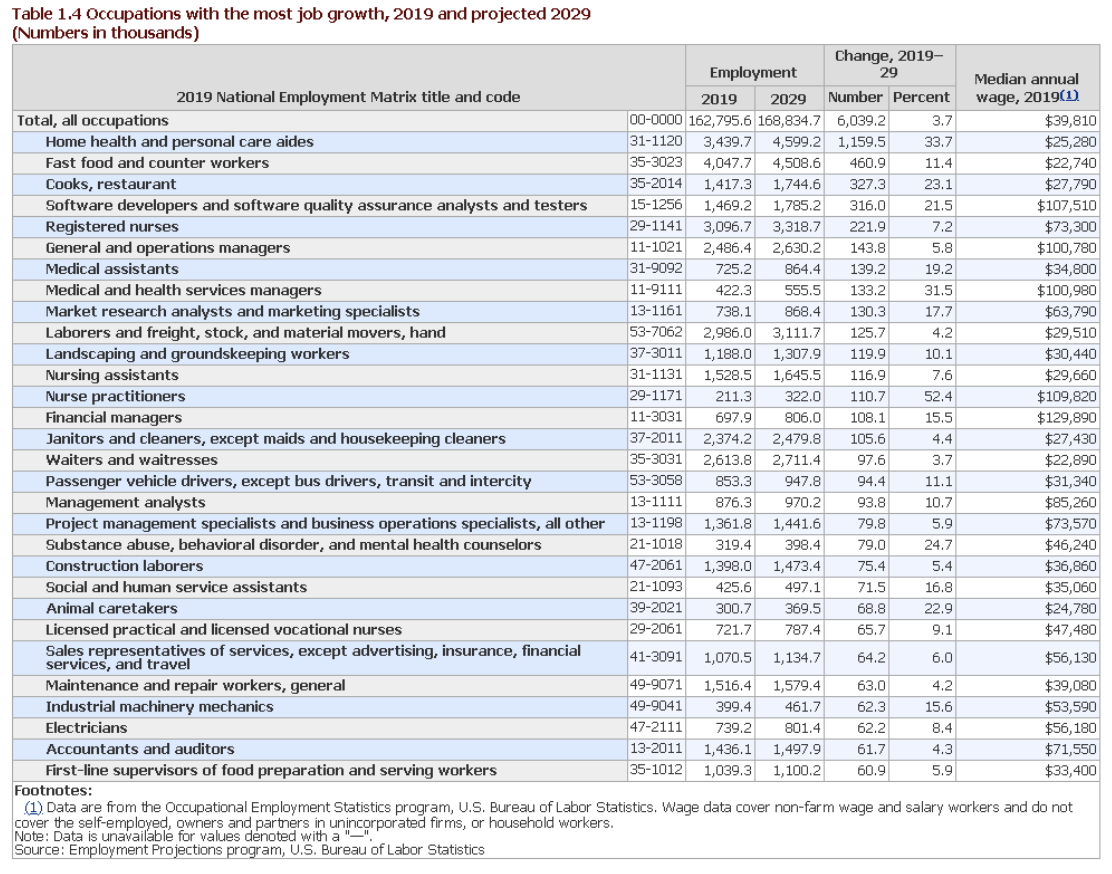

The USC Canna-TAM predicts 49.5% growth of the cannabis industry—not counting the markets that legalized in November, meaning the true number is far higher—by 2023 alone, to say nothing of a full decade of growth. Thus, if the BLS did report cannabis information, it surely would have several jobs in the above table.

Cannabis Employment Increases

Despite nearly ubiquitous gelid commercial conditions, some industries proved rime-resistant. Notably, while most hiring was cooling off, the cannabis industry was heating up. This steadfastness begged the question: “Does cannabis celebrate the Christmas season; is there a canna-Santa delivering temporary jobs at this time?” Graduate students at The University of Southern California’s Marshall School of Business teamed up with Whitney Economics to dig into the data. After exploring tax revenues collected by the states that have fully legalized adult recreational and medical cannabis use, the Marshall Cannabis Industry Club (MCIC) and Whitney Economics conclude that there is and there isn’t seasonality within the cannabis space. It exists notably where several factors work in concert, which are fleshed out below.

But before we look dive into the seasonality of cannabis, let us first admire the aforementioned strength of the industry in 2020. According to The University of Southern California’s Marshall Cannabis Industry Club’s Total Addressable Market Analysis (“USC Canna-TAM”) there were 57,139 new jobs created in cannabis in 2020 and a forecasted 45,686 jobs in 2021—not including the markets that just voted to legalize in early November. Together, they represent 21% and 14% growth YOY, leading to 321,250 and 366,936 total jobs, respectively. To further contextualize this growth, it occurred during a once-a-century global health crisis where the economy permanently lost about 3.8 million jobs (BLS).

The closest equivalent in growth, as of the last BLS report in September 2020, Wind Turbine Service Technicians were cited as having the highest projected job growth (61%) over the next decade. Notably, there are only an estimated 7,000 jobs in that field as that report (BLS). To fill out the picture, below is their table showing the fastest growing professions (Figure 3). As cannabis is federally illegal, there is no BLS reporting of those jobs.

Seasonality

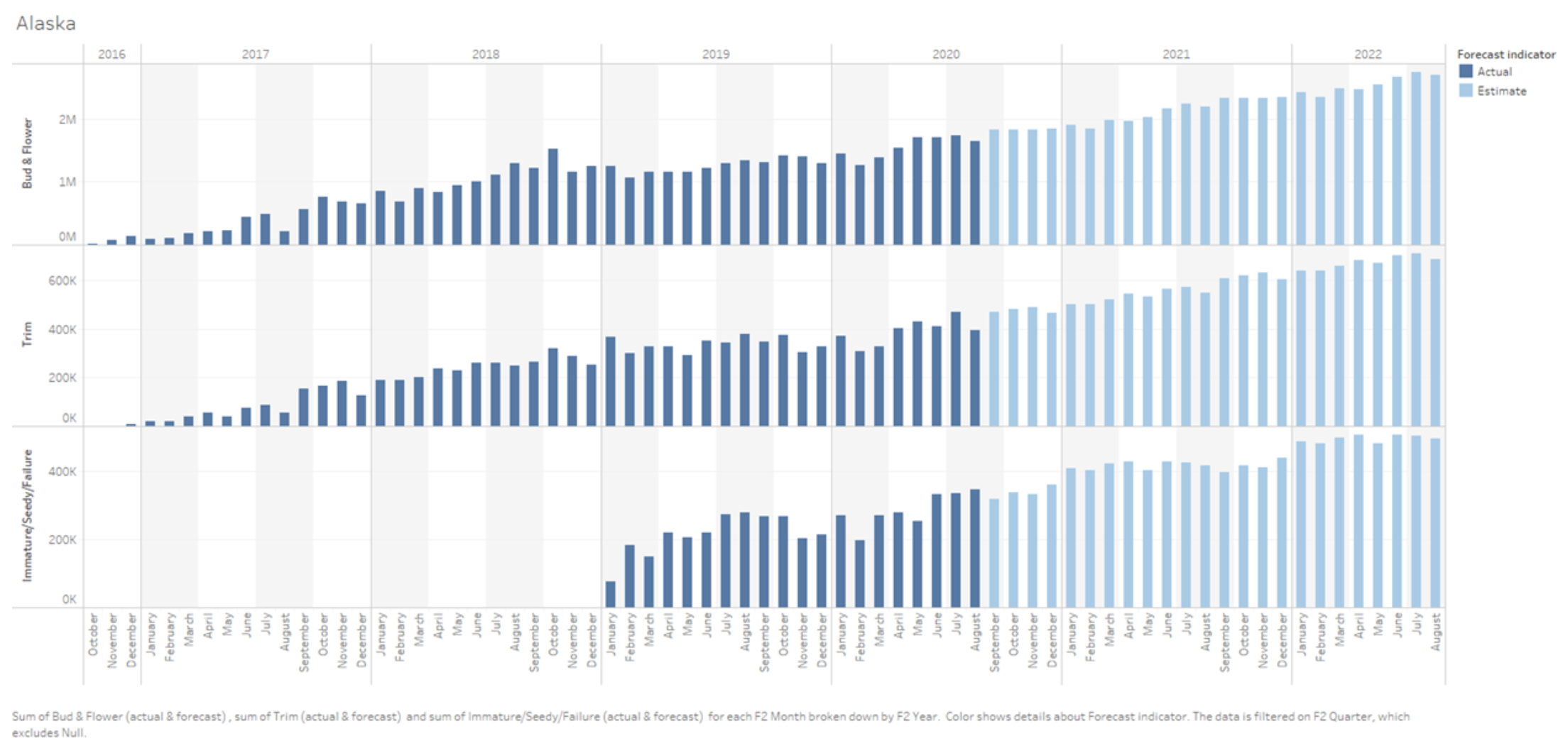

Now to the question “Is there Christmas in Cannabis?” Coincidentally, if unsurprisingly, the largest growths in cannabis jobs stem from the cultivation sector. As outdoor grow operations employ a relatively large number of laborers (sometimes up to five times what a comparably-sized greenhouse would hire), they are a prime candidate for seasonal work.

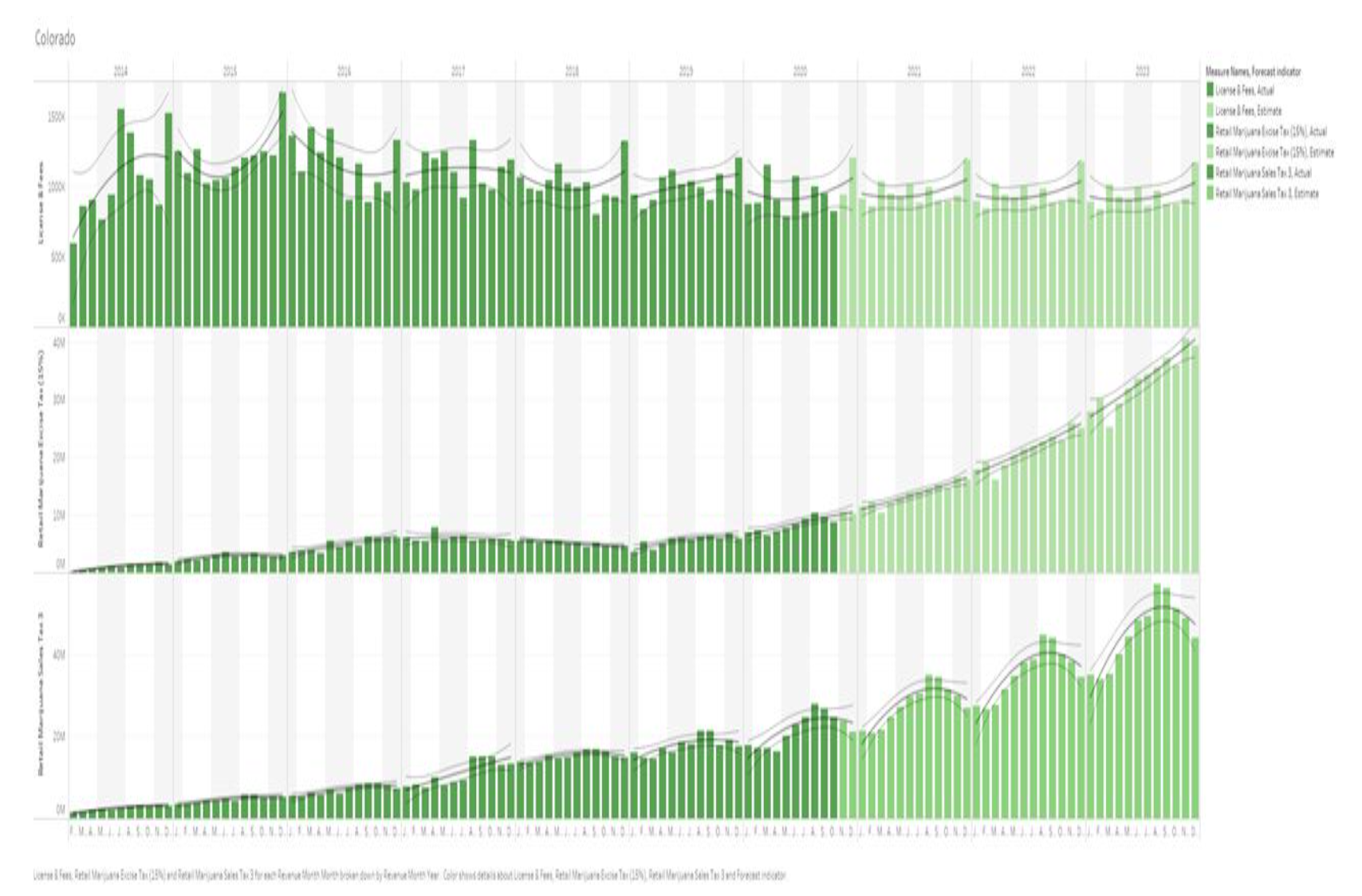

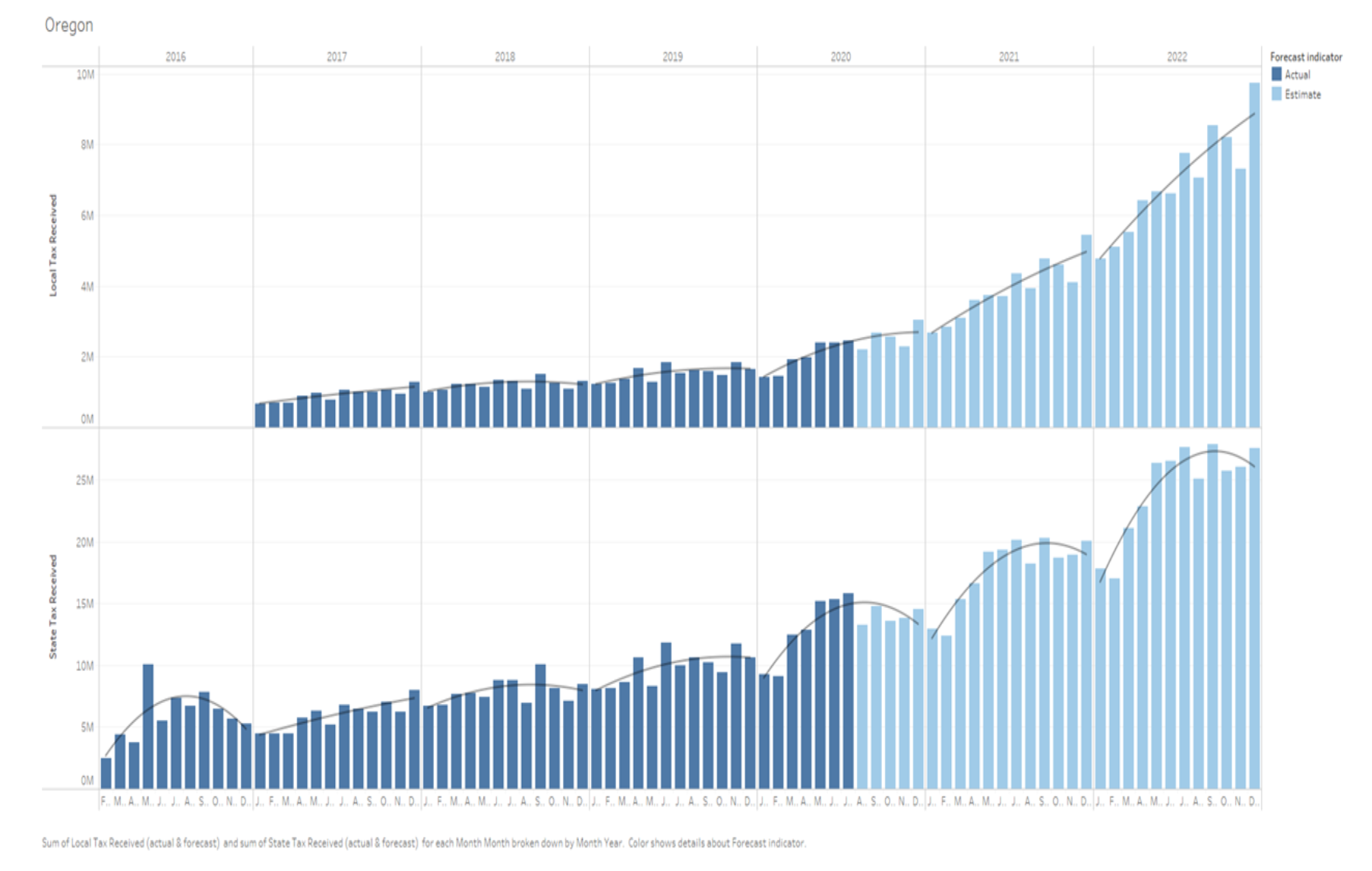

Whitney Economics explained to the MCIC that biomass price fluctuations can be used as a proxy for supply shocks. Price troughs roughly reflect the late fall harvest season in states like Oregon, for example (Figures 4-7). The resounding peaks a few months later demonstrate the suppliers’ shifts in purchasing habits to favor plants grown indoors, which are often higher in price and quality, even if they require fewer labor inputs. Moreover, as elucidated by Whitney, the lower price drives demand up in the legal market through a mix of movement from the illicit and cannabis’ high price elasticity of demand.

Traditionally, any outdoor growing season has led to an influx of seasonal laborers around Christmastime. Think of everything from Christmas trees to turkey harvesting. This mirrors the hiring and firing practices of other industries, at least in states that show strong seasonality. But the winds of change and opportunity blow concurrently. Not only do cannabis’ jobs continue to increase steadily across the nation (with an expectation that the pace will quicken as legislation becomes less spiteful and legalization more ubiquitous), but also their seasonality declines with time.

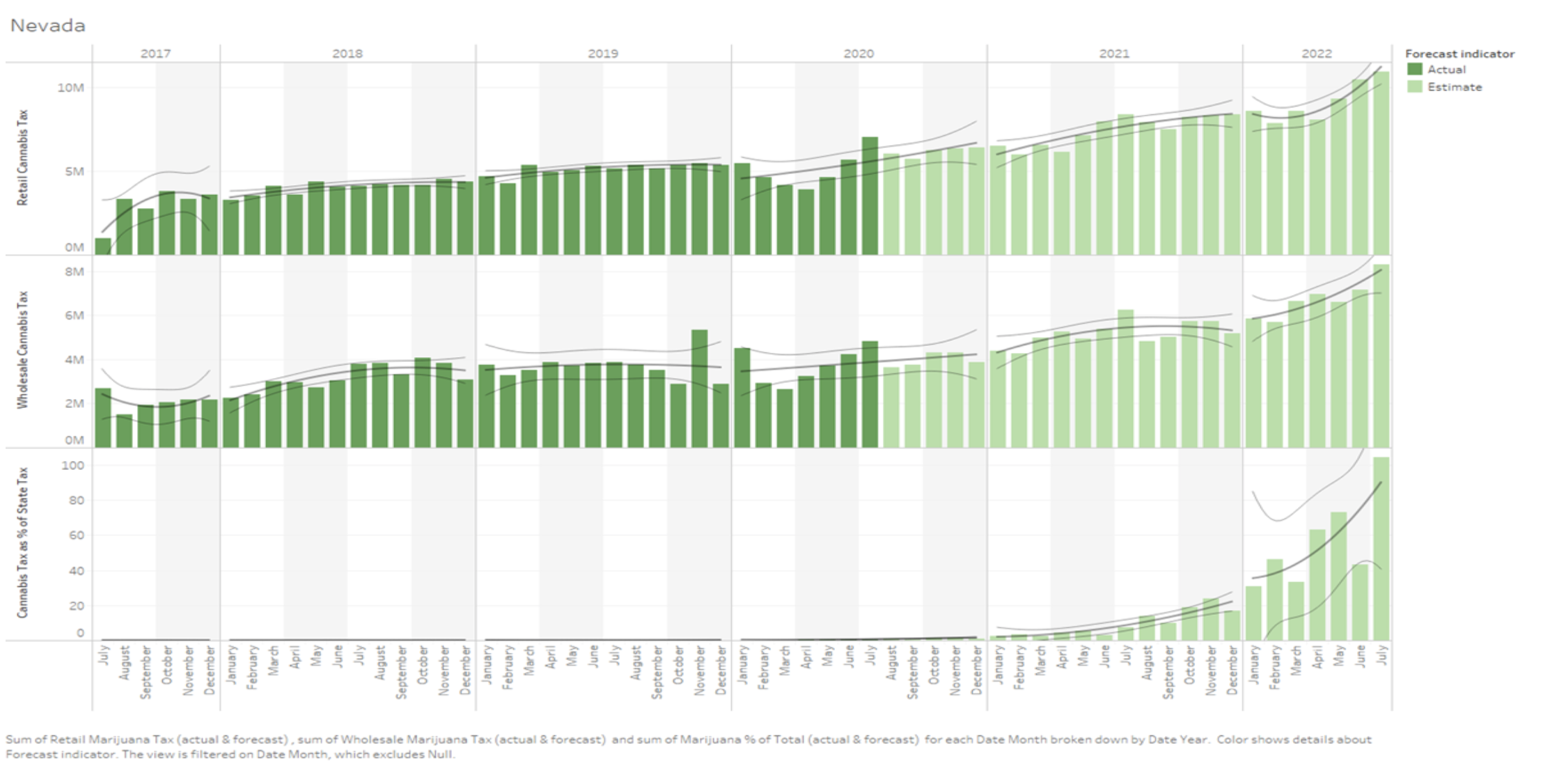

To preface, from the MCIC’s research, in tandem with Whitney Economics’, seasonality seems to be a state-by-state sliding scale with only a few variables profoundly affecting it. MCIC initially chose to focus on a tax-revenue analysis of Alaska, Nevada, and Colorado because of their very different climates and cannabis market phases. All three states showed very little seasonality and very strong job growth (Figures 4-7). Alaska is an early-stage market with inhospitable outdoor conditions. This means it served as a tantamount example of a greenhouse-only market. Nevada’s market is more mature—it is mid-staged—and its growers mainly use hybrid greenhouses (natural light with the rest of the climate controlled) allowing it to serve as a proxy for markets in between the other extremes. Colorado was chosen as it is a late-stage market with a mixture of climates and grow operations. As expected, Alaska has no clear seasonality due to its dearth of outdoor grows.

Nevada’s high tourism suppresses supply shocks by offering a steady stream of out-of-state demand (especially because tourists’ basket sizes are substantially larger than residents’, according to Whitney). Colorado has legislation precluding the expansion of a cannabis operation unless 85% of the plants are “homed,” thereby insulating it from the temperature-related volatility Oregon experiences. The Beaver State shows strong seasonality, possibly the epitome of the seasonality assumptions realized, and thus likely has more variations in price and supply than would be expected nearly anywhere else in the country. Through these examples, Whitney and MCIC concluded the most pertinent factors for cannabis’ seasonality are climate, legislation, percent medical population, and market stage.

As touched upon above, climate determines whether there is one legal market or are two. Considering the price of indoor cannabis can be two or three times the price of outdoor (according to Whitney) this is the most substantial variable. Next, legislation, specifically related to taxation. According to a model by Whitney, when the tax rate exceeds 15%, there is a strong migration from the adult-use market to the illicit, which shields the market from extensive volatility. California, whose illicit market is estimated by Whitney to be worth over $5 billion, is the prototypical example of a state which should see strong seasonality in a totally adult-use market but likely has these fluctuations suppressed by the illicit market. In the same vein, medical patients drive a more seasonal supply than do adult users due to the specifics of growth allotments and overflow legislation. Of course, more mature markets are better able to predict and plan for price changes over the year. They also are often more efficient, leading to a decline in wild variations in supply.

The result of these points is that hiring in cannabis should increasingly operate independently of any supply seasonality, as there is a myriad of demand-stabilizing factors. Canna-Santa comes year ‘round. As shown by the MCIC, seasonality is already a concept that either never existed, has been phased out, or should be diminished in several states. Further, as the industry is growing at such a meteoric pace, workers can be hired in anticipation of a YOY increase in demand, more efficient supply chains, and a need for knowledge. Ergo, the best-case scenario from a business perspective is to hire as many permanent workers as possible with the understanding that profitability should increase correspondingly with the cannabis market.

Also, economic impact is not reduced merely to the supply and demand of labor and commodities—dollar turnover and taxation are also tantamount. Therefore, the quality of cannabis jobs—jobs that should be relegated to seasonality only as a last resort—matters, too. As an aside, frankly, contract firms will likely rise to meet this demand when the markets hit that level of maturation whereby full-time hiring is less optimal, yet that should not happen until that market’s absurd growth slows. Luckily for all, cannabis jobs, on average, pay 11% higher than the US’ median salary (Renzulli, 2019). When coupled by Whitney’s economic impact number of $2.50 spent generally for everyone generated in cannabis, this tells a story of good, stable jobs with clear opportunities for advancement. Jobs which create the much-needed tax revenue that is spent on education and other social services, helping to offset the COVID crash. Finally, many states put language in their legislation stipulating some of that goes toward social equity programs that especially buoy people of color. Referring all the way back to Figure 2, COVID-19, much like cannabis criminalization, asymmetrically affected people of color, rending cannabis’ contributions to righting the racism of the past more temporally pertinent than ever.

A riveting, yet unexpected insight from this investigation is just how substantial the amount of tax revenue that is generated by cannabis for states, specifically during the COVID crisis. In June 2020, just under 40% of Nevada’s excise tax revenue came from cannabis, for example. More research needs to be done to see if canna-tax is cannibalizing tobacco and liquor tax. Although some may argue that all are vices, the data is scant and ambiguous, at best. Clearly, cannabis lacks the capacity to accidentally kill someone, as it is literally impossible to overdose on it. The greatest risk is motor vehicle impairment, on which more data and studies are needed. A highly cited paper by Sewell, et al, states: “Epidemiological studies have been inconclusive regarding whether cannabis use causes an increased risk of accidents; in contrast, unanimity exists that alcohol use increases crash risk.” (Sewell, R Andrew, et al.) Another unambiguous revelation pertains to how tax dollars are used: cannabis’ is spent on education and deterring reincarceration, whereas tobacco and alcohol’s are not.

In Conclusion

As branding, THC content, and user experiences continue to underpin success and failure in this industry, coupled with an expected influx of low-skilled labor jobs, the value of human capital and knowledgeability is growing faster than the plants they are employed to harvest, understand, and market. If, YOY, firms can retain workers, their efficiencies should eventually outpace those that have to re-hire and re-train new people annually. (All this is not to mention the benefits of internal promotion. The MCIC with Whitney theorized that cannabis job promotion is faster than comparable light industrial work and are intending to pursue this research next.) In conclusion, it’s always Christmas in cannabis. Give your business the gift of productivity without trepidation that growth will stall or concern for whether employees should be retained after the boom. If the market and firm are ready to expand, it is a good time to expand.

Bibliography:

“Job Market Remains Tight in 2019, as the Unemployment Rate Falls to Its Lowest Level since 1969 : Monthly Labor Review.” Edited by U.S. Bureau of Labor Statistics, U.S. Bureau of Labor Statistics, U.S. Bureau of Labor Statistics, 1 Apr. 2020, www.bls.gov/opub/mlr/2020/article/job-market-remains-tight-in-2019-as-the-unemployment-rate-falls-to-its-lowest-level-since-1969.htm. https://www.bls.gov/opub/mlr/2020/article/job-market-remains-tight-in-2019-as-the-unemployment-rate-falls-to-its-lowest-level-since-1969.htm

“Employment Buildup.” Edited by Osman Alhassan, U.S. Bureau of Labor Statistics, U.S. Bureau of Labor Statistics, Oct. 2019, www.bls.gov/opub/btn/volume-8/holiday-employment-in-retail-trade.htm. https://www.bls.gov/opub/btn/volume-8/holiday-employment-in-retail-trade.htm

U.S. Bureau of Labor Statistics. “Industries with the Fastest Growing and Most Rapidly Declining Wage and Salary Employment.” U.S. Bureau of Labor Statistics, U.S. Bureau of Labor Statistics, 1 Sept. 2020, www.bls.gov/emp/tables/industries-fast-grow-decline-employment.htm. https://www.bls.gov/emp/tables/industries-fast-grow-decline-employment.htm

Kim Parke, Rachel Minkin, Jesse Bennett. “Economic Fallout From COVID-19 Continues To Hit Lower-Income Americans the Hardest.” Pew Research Center’s Social & Demographic Trends Project, 30 Oct. 2020, www.pewsocialtrends.org/2020/09/24/economic-fallout-from-covid-19-continues-to-hit-lower-income-americans-the-hardest/. https://www.pewsocialtrends.org/2020/09/24/economic-fallout-from-covid-19-continues-to-hit-lower-income-americans-the-hardest/

Sewell, R Andrew, et al. “The Effect of Cannabis Compared with Alcohol on Driving.” The American Journal on Addictions, U.S. National Library of Medicine, 2009, www.ncbi.nlm.nih.gov/pmc/articles/PMC2722956/. https://www.ncbi.nlm.nih.gov/pmc/articles/PMC2722956/

Renzulli, Kerri Anne. “Cannabis Jobs Pay 11% More than the US Median Salary, and Demand Is up 76%.” CNBC, CNBC, 4 Feb. 2019, www.cnbc.com/2019/02/04/cannabis-jobs-pay-11percent-more-than-the-us-median-salary.html.